Reviewing your property’s expenses – if you haven’t done so in a while – could be a good place to start. Minimize operation expenses: bleeding money is a terrible thing for any investment.Creating extra income: outside the realm of increasing income or decreasing loss is the creative route new ideas and strategic partnerships to increase the cash flow pipe outside of filling vacancies or increasing rent, like having billboards and big posters on the building for extra ad revenue, extra parking levels where parking is scarce, or even extra pet fees from existing tenants.But here are three tips to help you improve your investment’s performance. As we mentioned earlier, it’s about increasing flow and/or decreasing costs. There’s no special formula or hidden way to increase your NOI. Let’s expand on how you can maximize your NOI. Then, improving your overall cash flow from the property could be achieved by strategically cutting operating costs or by creatively increasing rental income. It will allow you to compare expenses and see if yours are too high. In reality, you can compare one property’s NOI to a similar one in the same area. Truthfully, there’s no such thing as “good” NOI. This helps lenders and investors know if the property’s generated income covers its debt payments alongside the usual operating expenses. NOI is also used when calculating the total ROI/IRR, cash return, and net income multiplier.įinanced properties use NOI in their DCR (Debt Coverage Ratio) formulas.

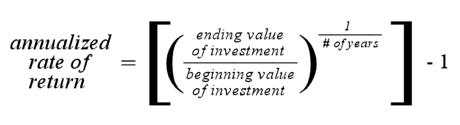

But your property might yield cash flow from other venues and amenities, such as a laundry facility, electric car charging stations, vending machines, and parking structures.Īs mentioned, capital expenditures, such as the cost of new solar roof panels, or a new HVAC system for the entire building, are not included in the calculation.Īlso not included are the operating expenses, like the cost of running utility repairs, maintenance (cleaning and repair services-including insurance premiums).Ĭalculating the NOI will help you determine the capitalization rate – which actually helps you appraise the property’s value-ultimately letting you compare between different property investment opportunities (when selling or buying). Now that we generally grasp NOI better, let’s dive in a bit more.

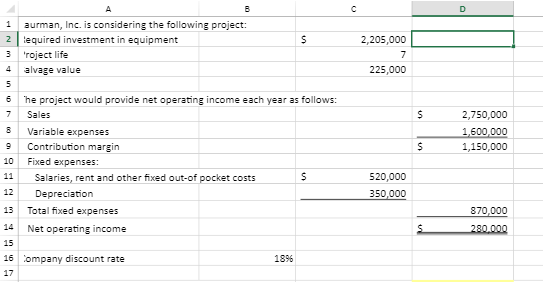

OE = operating expenses Understanding NOI Operation expenses, for example, could be property taxes, insurance, and repairs. Revenue could come from rental income, parking fees, service charges, and so on.

#Noi calculation depreciation how to#

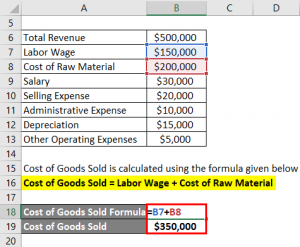

How to Calculate Net Operating Income (NOI)Īs stated, calculating NOI is simply subtracting the operating expenses from revenue generated by a property. Your EBIT, however, will be $13,800,000, since it takes depreciation expenses into account. Depreciation expenses will cost you another ~ $200,000. You invest and purchase a property that generates $20,000,000 (rent & fees). Simply put, in real estate, there aren’t any “sold goods”, therefore, NOI is unique to RE. NOI is used to analyze the ability of RE properties to generate income.ĮBIT, however, is determined by subtracting a company’s COGS (cost of goods sold) AND operating expenses from its revenue. In other industries, this metric is called “EBIT” or Earning Before Intrest and Taxes.

This figure excludes the principal and interest payment on your loans, deprecations, amortization, or capital expenditure. It is purely a before-tax figure that appears on the property’s income statement. NOI is basically all the revenue from a property minus all the necessary operating expenses. NOI or Net Operating Income is a calculation used to measure the profitability of cash flowing (income-generating) RE investments. Let’s talk about NOI and GPR as barometers for your next CRE investment. If you want to better understand how your commercial real estate investment performance is being measured, look no further. On top of that, the complicated acronyms and complex formulas of the field can cause confusion even for veteran investors. Commercial real estate investing is daunting because of how much capital and risk are involved.

0 kommentar(er)

0 kommentar(er)